Femtech Market Map of Southeast Asia 2022

Over 70% growth for the femtech industry in Southeast Asia within just one year. Nothing short of exponential growth for the region. What solutions have emerged? What is driving the growth? What is in store for next year and beyond?

fermata Singapore’s 2022 femtech market map for Southeast Asia dives into these questions to help navigate this rapidly evolving landscape.

We hope to shed light on the reality that there is in fact a demonstrated need for and generation of femtech solutions in Southeast Asia.

The conversation thus far in this region has often revolved around questions of whether there is a market for femtech; a more engaging dialogue is to better understand how these solutions are transpiring in Southeast Asia compared to other regions, and what is needed to support their adoption.

Jump to section

A quick recap of last year’s findings.

- fermata Singapore created the first ever Southeast Asia Femtech Market Map.

- The term “femtech” was coined in 2012 consisting of the words “Female” and “Technology”, and has since grown into a booming industry of technology companies addressing women’s health needs.

- Across Southeast Asia, we saw 41 femtech companies out of 1,000+ globally.

- Singapore was considered the leading country consisting of 24 femtech companies, followed by Thailand with 6 femtech companies.

- Period Health and Sexual Wellness appeared to be the most popular categories - with menopause seeing the least activity however indicated plenty of opportunity in the market with Asia holding one of the fastest ageing population.

- In countries such as Cambodia, Laos and Myanmar, we were unable to find femtech companies through our desktop research and network, presumably due to the need to be more focused on general public health issues, period poverty and hygiene safety.

- Women’s health issues are identified as one of the biggest cultural and social taboos spread across Southeast Asia.

- There is a need for education within women’s health to bust myths and allow the market to have knowledge over their bodies.

- The global pandemic helped start the femtech movement in Southeast Asia, for women to want to take more responsibility for their health and for companies to want to find a way to close the gap for them.

Let's turn to 2022.

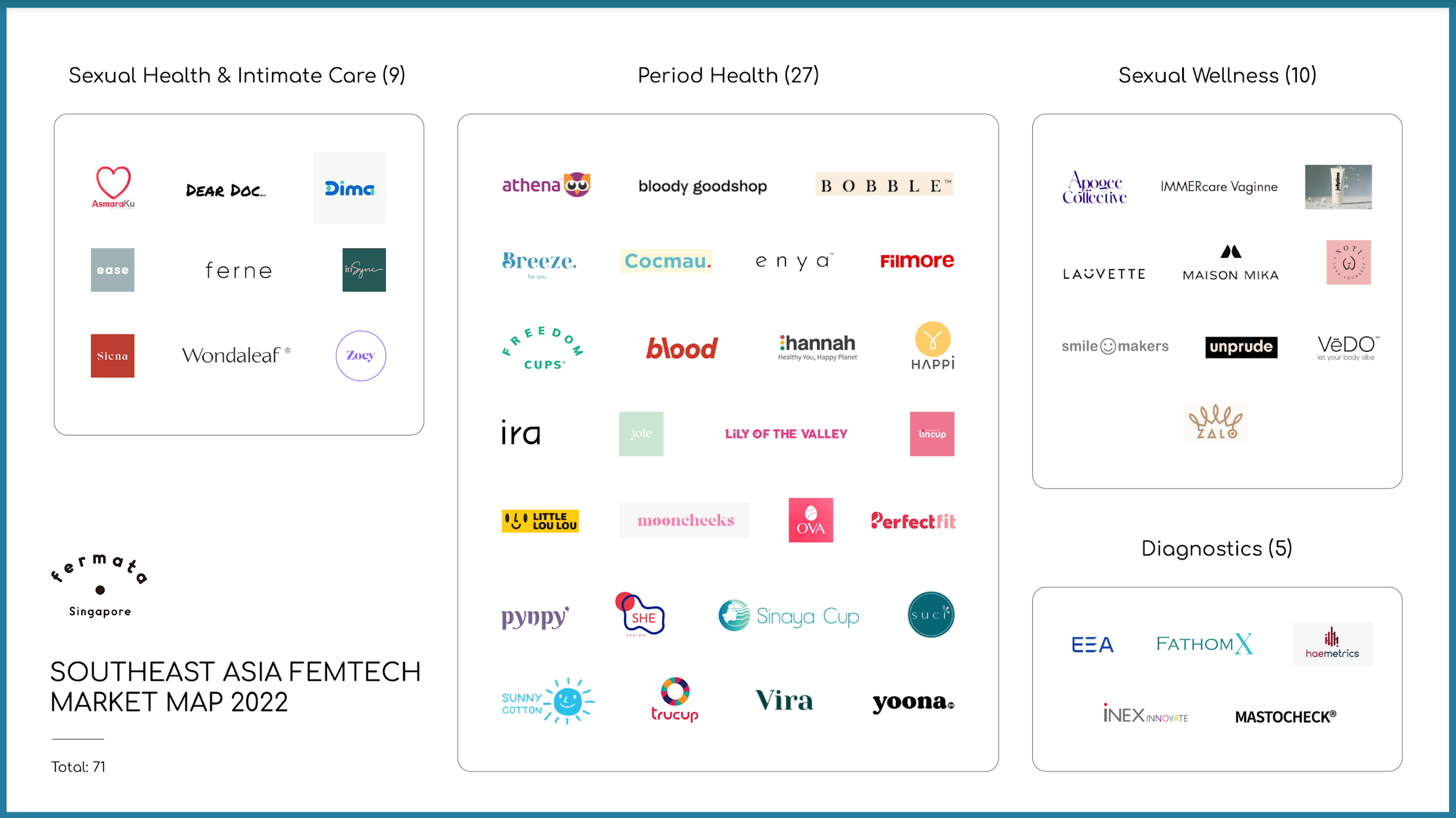

2022 Southeast Asia Overview

In 2022, there are 71 femtech companies across Southeast Asia.

Singapore continues to be the leading market with 32 companies (↑45%), and Malaysia surpassing to the second lead with 12 companies (↑500%).

Across the region, there seems to be steady growth in the Philippines with 9 companies, Thailand with 6 companies, Indonesia with 5 companies and Vietnam with 4 companies.

There has been no change in Cambodia, Laos and Myanmar as they presumably continue to focus on essential public health initiatives and basic women's needs such as period health education for the younger generation, to encourage them to remain in school.

In Myanmar, following the military coup in 2021, and the rising prices on sanitary pads, local women have been finding it difficult to access period products. While there is some help from volunteers and NGOs who are working to crowdsource period solutions - survival is their utmost priority.

Category Breakdown

B2C Solutions:

Sexual Wellness

Despite sex and pleasure (especially female pleasure) being a taboo topic amongst communities in Asia, sexual wellness is still emerging but also maturing with more companies coming onto the market. Singapore currently leads the category with the likes of Smilemakers, Maison Mika and newly established Apogee Collective -- a joint partnership between Genvie (formally known as Good Vibes) and The Hedonist.

Over the last year, the number of sexual wellness companies in the Philippines has grown to 40%: Jellytime, Lauvette, Noti and Unprude. These companies share similar missions to stepping into empowerment through education and self-pleasure.

Sexual Health & Intimate Care

We decided to separate the categories for sexual wellness and sexual health & intimate care as they continue to expand. This year’s report includes companies such as Ease Healthcare, Siena Health, Ferne Health, DearDoc and Insync Medical providing screening, testing and treatments focused around the sexual and reproductive organs. We also have TWO L(I)PS, the world’s first intimate skincare range for the vulva - helping women feel more confident.

Last year, we saw the biggest activity in sexual health happening in Singapore. However, the category has since grown in other countries. Examples include AsmaraKu, a full-spectrum sexual health ecommerce platform in Indonesia; Wondaleaf, a unisex condom in Malaysia; and Dima, an online pharmacy for sexual health in the Philippines.

Fertility & Infertility

Lumirous, twoplus Fertility and Yesmom continue to be the pioneers in the fertility space across Southeast Asia.

With the falling birth rates across the world, and governments placing a spotlight on encouraging compensation initiatives to boost family planning in Southeast Asia - there is still plenty of opportunity for growth within this sector especially in markets such as Singapore.

Period Health

Alongside sexual wellness, period health is a top category within the region. In fact, this category has seen the largest activity within the year growing by 107%. Malaysia and Thailand currently hold the largest market share for period companies selling organic tampons, organic & reusable sanitary pads, and menstrual cups.

Period taboos are also beginning to shift, even in the workplace. Earlier this year, Blood – a period health start-up in Singapore launched a Period Positive Workplace Survey – surveying over 1,000 women, that captured the headlines in the media, in hopes to implement period policies and recognising “period leave”.

Perimenopause & Menopause

Perimenopause and Menopause affects 50% of the world’s population and symptoms can be disruptive to personal and professional lives. Quality care in this category can play a vital role in health, aging and quality of life. However, it is one of the most underserved life stages in terms of awareness, access and education.

Currently in the market, we have players such as EloCare in Singapore specialising in IoMT developing connected and smart healthcare devices for optimised chronic and ageing care; and soon-to-launch Mona, a personalised menopause platform in Vietnam.

Pregnancy & Postpartum

Femtech products within this category help alleviate concerns for mothers-to-be and gives opportunities for families to bond and learn more about their babies before birth – and allows medical professionals to gather more data and close knowledge gaps.

The current players in the market continue to be Biorithm, JioVio in Singapore and Sehati TeleCTG in Indonesia - all which provide monitoring devices to measure real-time data for mother and baby.

Women’s Wellness (General Health & Wellness)

A new and growing category has emerged for this year’s market map as we are starting to see more interest in bettering women’s health and wellbeing, both mentally and physically.

These include startups such as Kindred, a full spectrum women-centric clinic in the Philippines, Moom Health providing natural remedies for the modern women, and ZaZaZu, who recently pivoted from a sexual wellness platform, to creating a specialized programme focusing on taboo topics for women in leadership from microaggression & sexism to building confidence in competency.

Women’s Wellness (Telehealth)

As more research is conducted and data is gathered around women's health, we are finally beginning to gather more data around women’s health, thanks to industries like femtech - we are finally beginning to understand how different men and women's bodies are - and how diseases or health conditions can affect women differently or disproportionately.

SpeedDoc and Doctor Anywhere have dedicated health screening packages tailored for women, demonstrating the potential for women’s health solutions to be delivered through digital health platforms and organizations.

B2B2C Solutions:

Within the healthcare industry, public and private sectors alike, we are beginning to see new B2B2C solutions for the medical industry to adopt and better address women’s general health and preventive care.

Through the use and launch of new and innovative solutions, we are seeing progress in the types and quality of healthcare that can be extended to women.

Diagnostics

This category is key to ensuring our healthcare professionals can better address women’s unique healthcare needs in areas such as bone health, chronic conditions, and female-specific cancers etc.

New breast cancer screening technologies have flourished in the past year. FathomX is a digital health AI spin-off company from the National University of Singapore and National University Health System. The company's flagship product, FxMammo, is an AI assistant that significantly improves the screening procedure of mammograms by reducing the false positive/negative rates and enhancing the clinical workflow by increasing efficiency.

In September of 2022, the Raffles Medical Group (RMG) announced the launch of Mastocheck®, a blood-based test to screen for breast cancer. RMG is the first healthcare provider in Singapore to introduce this innovative diagnostic tool.

We are excited to see what new products will be launched in this field in 2023. There are new developments on the horizon for INEX Innovate and their epiDx® solution which is a blood-based liquid biopsy test for the diagnosis of breast cancer based on the epigenetic differences between breast cancer and healthy individuals.

Turning to innovations in the field of point-of-care devices, we’d like to highlight advances in the screening for female-specific cancers as well as women's hormonal health. INEX Innovate's OvaCis® , is a globally patented point-of-care device that discriminates benign from malignant epithelial Ovarian Cancer in 15 minutes. Haemetrics is tackling women’s reproductive health, by building a proprietary, automated point-of-care platform for comprehensive analysis of female health-associated hormones from blood samples. Making diagnosis simpler and more affordable for clinics, this solution is empowering doctors and patients to make informed decisions in a timely manner. Better knowledge and tools to learn about women’s hormonal health is critical and impactful across all the chapters of a woman's life.

Lastly, E3A Healthcare, 1st runner up in Singapore’s 2022 Slingshot competition, is active in the smart newborn and women's health devices. Their YSJ Series Newborn Transcutaneous Smart Bilirubin Meter provides an at-home medical device for parents to diagnose neonatal jaundice. While we have placed them in the Diagnostic’s category this year, they have a diverse set of products in the pipeline. Their products range from a babycare Saas Platform for remote newborn healthcare management, to smart fertility monitors and period Health products such as a Smart Non-Invasive Menstrual Pain Relief Device.

Fertility (Women in the workplace)

A new category added this year is focused on women’s health and wellness in the workplace through improved HR health and fertility benefits. A leading player in this space is Carrot Fertility, a global solution for fertility benefits. They expanded their global network into Southeast Asia in 2019 and is now operational in Singapore and most countries in Southeast Asia. Carrot helps employers and health plans provide equal access to high-quality fertility care regardless of age, race, income, sex, sexual orientation, gender identity, marital status, or geographic location. They provide deep, equitable support for all journeys, including fertility preservation like egg and sperm freezing, IVF, donor and gestational carrier services, adoption, pregnancy, and menopause and low testosterone.

As employers and HR departments are looking to expand and improve their Diversity, Inclusion and Equality (DEI) programs for the workplace, companies are embracing new solutions that have a direct impact on how we accompany women across all chapters of their life in the workplace.

Sexual Health: B2B testing for women’s intimate care products

In 2022, microbiome testing startup Sequential Bio, a spin-off to the A*StartCentral (A*SC) programme, offers end-to-end in vivo solution to support microbiome-friendly claims. Their B2B testing arm supports vaginal microbiome brands and products from femtech companies in Singapore.

The pathway to commercialisation for femtech products and solutions can often require Research & Development along with clinical studies before reaching the market. This is why we have created a Market Access Facilitator category to represent new companies in the B2B space growing to support the launch of femtech products.

Our intuitions tell us more of such companies will be appearing to support the launch of women’s health dedicated solutions onto the market.

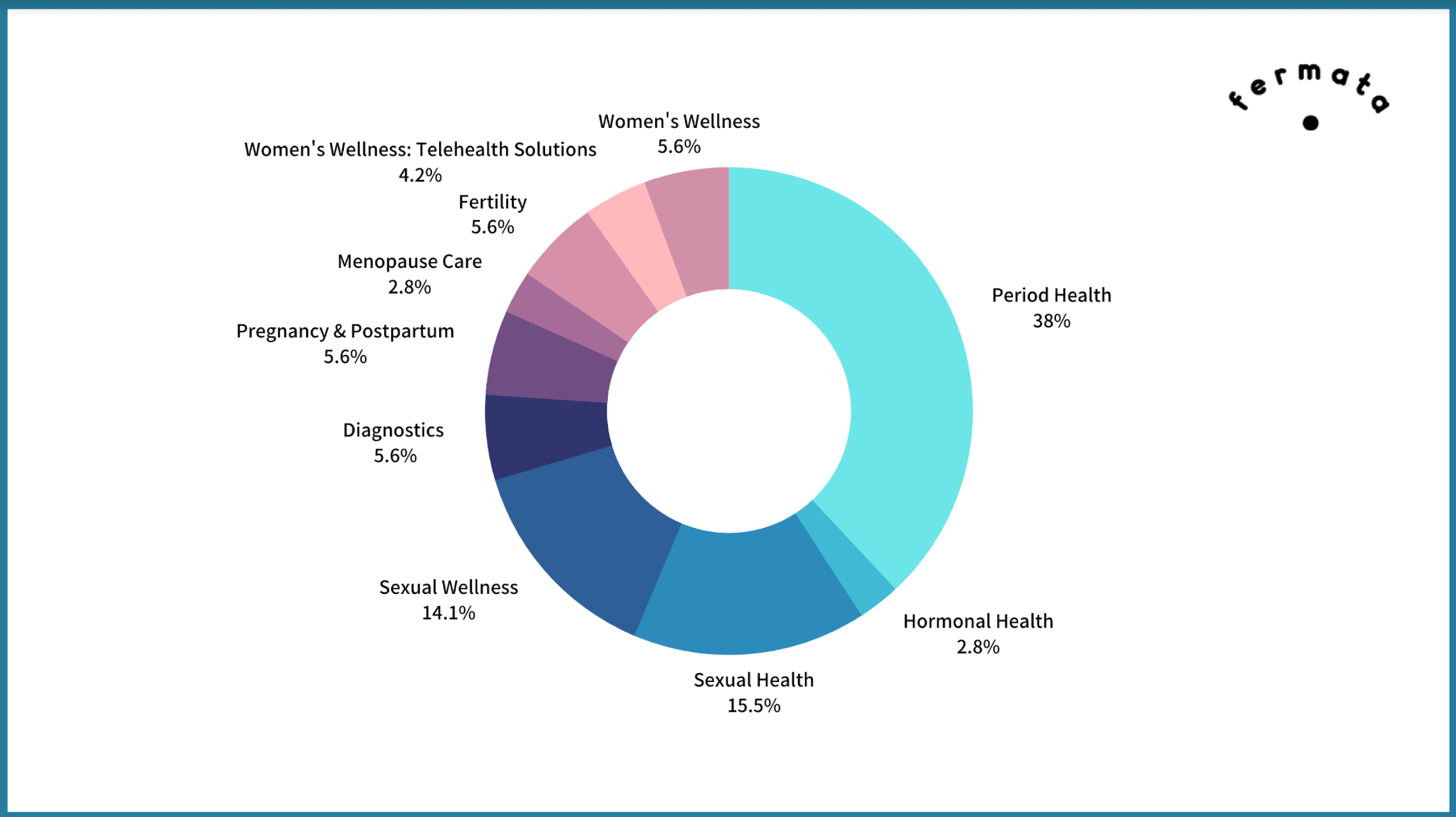

Distribution of femtech companies in Southeast Asia per category

Below is an overview of how these 71 companies from Southeast Asia are distributed per category :

Distribution of femtech companies in Southeast Asia per type of service

Now let’s see how these same 71 companies are distributed per type of service or product type :

Women’s Health & Wellness Communities

We would like to shine a light on the growing number of community actors and associations that play an important part in growing the ecosystem, and creating a safe space for members to go to.

We would like to shine a light on the growing number of community actors and associations that play an important part in growing the ecosystem, and creating a safe space for members to go to.

Support communities such as MyEndosis established in 2013 in Malaysia support women's health challenges such as Polycystic ovary syndrome (PCOS) and Endometriosis, encouraging general awareness and peer support. There has also been a growing community for pregnant and postpartum mothers like Empowa and The Anjea Way, to ensure mothers feel supported emotionally, mentally and physically.

Femtech Association of Asia was created as the region’s first network for femtech founders, professionals, investors and enthusiasts uniting with a core focus on improving women’s health through technology solutions. Its members consist of 40 femtech companies across Southeast Asia, Japan, South Korea and India - and operate across over 10 categories from menstrual care, to menopause and diagnostics.

Singapore 2022 : “The Femtech Hub”

Undeterred by its small market size, Singapore continues to be the leading market for the femtech industry due to its friendly ecosystem for startups. In August 2022, Business Times reported being “ranked as the No 1 ecosystem for startups in Asia Pacific in 2022. It's home to 12 unicorns and more than 3,800 tech-enabled startups, which has contributed to an ecosystem worth an estimated US$89 billion.”

Singapore is a great test bed for new technologies especially for femtech products and services, before considering market expansion into much larger markets This can be notably seen through Fig Fertility (2021) which rebranded to Simone Health and relocated to the US market, as well as by Ease Healthcare and Ferne Health which expanded their services into Philippines and Indonesia.

Several other factors have impacted the Singapore landscape since 2021, which have been seen through societal, legislatives and governmental forces that have created new avenues for dialogue in women's health and wellness. Let’s dive into a few of these topics where we’ve noticed an uptake in activity in 2022.

RESEARCH & DEVELOPMENTThe Singapore National Research Foundation launched the Research Innovation Enterprise Plan 2025 (RIE2025) in December 2020, with an approximate S$25 billion budget. Under the RIE2025 plan, Singapore’s strategy for research and development is targeted to support research in four domains. Each research domain is tackled at different levels (Academic Research, Manpower, Innovation and Enterprise).

Of special interest for the femtech industry, we’ve decided to highlight two of the four research domains: the Human Health and Potential (HHP) and Smart Nation and Digital Economy (SNDE).

Human Health and Potential (HHP) - Early Life Research

In 2022 we saw the launch of ASTAR’s 2nd Prenatal and Early Childhood Grant Call. The “prenatal and early childhood” covers the life course from preconception, pregnancy to early childhood (-1 to 6-year-old). Of the desired outcomes for this Early Life Research, the pillar dedicated to “Improving Maternal Health and Well-being” is broken down to two key points listed below:

The RIE2025 strategies under this pillar are an important catalyst for new initiatives turned towards supporting research and targeted programs to support maternal health in Singapore.

Smart Nation & Digital Economy (SNDE)

We also should consider a second pillar of the RIE2025 plan, the Smart Nation and digital economy (SNDE) as closely related to the future of digital health solutions and within that segment women’s digital health solutions. Prioritizing research in the field of AI, Trust Technologies, Data Security is at the heart of emerging femtech solutions.

Amongst other initiatives in Singapore, the Healthy Early Life Moments in Singapore (HELMS) study, launched in April 2022, looks into a new model of care that offers early intervention to improve mental and metabolic health in women even before they become pregnant.

We are truly excited to see how key universities and research agencies are moving towards women’s health specific programs. Supporting research and development funding in this field is critical to tackling the issue of women’s health at the root.

SOCIAL & MEDIA DIALOGUES: FERTILITY

In early 2021, Singapore’s total fertility rate was reported to be at a historic low. The government has been determined to increase initiatives and subsidies, to encourage family planning. However, soon after we published the first market map, the headline “Singapore’s Egg-Freezing Ban Forces Women To Head Overseas”, sparked a debate through Singapore, especially around future fertility and family planning.

One voice in particular was Emma Zhang, the creator of the Instagram accountMyEggsMyTime and an online petition, urging to change the family-planning dialogue and legislation of elective egg-freezing.The petition has since garnered over eight thousand signatures (as of 21 December 2022).

Earlier this year, The People's Action party released the White Paper on Singapore's Women’s Development on Monday (Mar 28), with proposals for 25 action plans in five key areas. The five areas are equal opportunities in the workplace, recognition and support for caregivers, protection against violence and harm, other support measures for women and mindset shifts. With this, women aged 21 to 35 in Singapore could soon choose to freeze their eggs regardless of their marital status in 2023. However, they have to be married and within age to use those eggs.

We’ve also noticed local media outlets such as Channel News Asia: The Baby Makers joining the conversation around fertility, looking at femtech to help create more awareness and offer innovative fertility solutions for potential parents.

These types of dialogues are creating new opportunities within the community and for young changemakers to create initiatives to raise awareness such as Let’s Talk about Endo - a Singapore based campaign to raise awareness of endometriosis led by Singapore students Wee Kim Wee School of Communication and Information, Nanyang Technological University.

fermata Singapore’s Thoughts & Predictions

2022 has been a year of increased chatter and growing interest in femtech - we are confident that it will continue into 2023, along with more series of firsts. There has been undeniable growth but there are numerous opportunities to continue equipping women in Southeast Asia with new tools, medical solutions and access to knowledge about their health and wellbeing.

GROWTH & MOVEMENT IN THE FEMTECH ECOSYSTEM

We will continue to see the growth of the femtech industry in Southeast Asia and its increasing influence on the larger community, society and business environment.

How we are envisioning this for 2023:

From a community and society perspective, education and awareness activities will continue to shine the light on topics which remain taboo or stigmatized within our region. From period health to menopause. These will be turned towards educating our consumers, businesses and government.

Looking towards 2023, there will be a series of national conferences and events focusing on women’s health, especially in Singapore - such as the Women’s Health Innovation Series in March 2023.

Governments are also taking notice and making regional efforts to understand the industry and brainstorm new governmental policies. This is yet another indicator of the region's growing presence on the global stage and the femtech industry’s growing maturity.

We are also excited to share that fermata Singapore is looking to bring our signature event from Tokyo to Singapore with Femtech Fes! 2023 in Q3-Q4.

Femtech Fes by fermata inc, is the world’s largest femtech exhibition that takes place annually in Tokyo, Japan. It is an unprecedented opportunity to discover the latest femtech solutions around the world and bring them into one room.

In 2022, Femtech Fes! had 200 companies exhibited and received over 3,500 attendees over three days.

From an academia and research perspective, we have seen funding programs for female reproductive science, grants or MedFemTech congresses emerge overseas to promote emerging medical solutions for women to improve diagnostics and treatment. We expect similar initiatives to appear in the region in 2023. The rise of MedFemTech and Biotech research initiatives dedicated to women’s health will encourage new scientific discoveries in women’s health and wellness.

From a business environment, we have noticed new B2B solutions dedicated to supporting the launch of femtech products and services. This is not surprising since a growing consumer market for femtech products goes hand in hand with a new demand for B2B solutions to support commercialisation and go-to-market efforts.We will keep a close eye on this new segment in 2023 and are excited to see where and how new actors will be emerging to support the industry.We anticipate this will continue to grow.

PUSHING THE BOUNDARIES OF ESTABLISHED MARKETS & CREATING NEW ONES

We will see industry players rethinking existing and established markets, while others explore completely uncharted or “white space” opportunities.

How we are envisioning this for 2023:

Rethinking menstruation. There are new and exciting discoveries being made on what we can learn from women’s menstrual blood. While not yet observed in Singapore or Southeast Asia, new solutions are emerging in Europe and APAC. The period health market is a popular and increasingly crowded space. New players are coming in and disrupting how we think of our periods and what they can reveal about our overall health and well being. Considering menstrual Blood as a powerful biomarker is pushing the boundaries of innovation in the field of fertility, diagnostics and preventive care. What else can we learn about our health from our menstruation cycle ?The period health market is just one of many to undergo disruptions.

Digital Health Services and At-Home Testing Solutions. While having emerged in the other regions such as the UK through JunoBio and Daye, at-home vaginal microbiome testing solutions are an untapped market in Southeast Asia. In a region where cultural taboos are more prevalent, these solutions could gain in popularity and accessibility especially considering how it is positioned to adopt new digital healthcare products and services.

Women’s Healthcare Data. A hot topic within the healthcare industry, and moreover femtech, is the question of data. Firstly on how we protect, store and communicate our sensitive healthcare data. Secondly, how do we address and correct the chronic lack of female (XX chromosome) data in the healthcare industry research and the impact this has had on clinical trials, new drugs & therapies.

From a consumer perspective, we can envision new tools which allow women to share their data and learn from their data in a secure environment. New solutions for aggregating and analyzing women’s healthcare data are already being piloted in other regions of the world, and now in Singapore. The rise of “Privacy Enhanced Trust” technologies will be one part of the solution. Singaporean startup, Soul DAAP, is a prime example of the progress made in this space and the conjunction between Web3, Blockchain and Women’s Health Data.

A GROWING ATTENTION TO MEN'S HEALTH

We are glad to see pioneers providing new solutions for men’s health. Men face their own set of gender specific health challenges and are also a key part of supporting women as they face milestones in their life (fertility, postpartum, menopause)

We’d like to bring attention to change markers in this space. We can look included Noah, AndSons and HeHealth, sexual health companies that address sexual health and reproductive health issues for men, and are also considered taboo in an Asian culture.

How we are envisioning this for 2023:

With the recent repeal of Section 337A of the Penal Code effectively ending criminalisation, we hope to see more being brought for gender-inclusive services for sexual health and mental wellbeing.

Final Remarks

We hope this bird’s eye view of 2022 has shed light on how the femtech industry has evolved, in its diverse cultural, religious, social and economical landscape of Southeast Asia. We look forward to seeing where the industry will continue to go and develop in the near future.

About fermata Singapore

fermata inc, is a Tokyo and Singapore-based startup providing one-stop market entry services and an e-commerce marketplace focusing on women’s health. We focus on product registration, import and localisation support to companies looking to enter the Japan and Singapore market, and host events to build awareness of femtech within the SEA and APAC region.

_________________________________________________________________________

Disclaimer

This market map was created with data gathered from public information by Francesca Geary-Stingl and Zoé Neron-Bancel from fermata Singapore. Although fermata Asia Pte. takes every reasonable step to ensure that the data thus compiled is accurately reflected in this Market Map, fermata employees provide the data “as is, as available.”

For further questions or collaborations, please reach out to singapore@hellofermata.com

Startup criteria for being featured in the market map

- Not IPO

- Launched after 2000

- Assess using scorecard

Is someone missing from our market map?

The femtech market is dynamic and moving fast. If you have a new submission you’d like to share please fill in the form HERE and our fermata Singapore team will review and get back to you !

Download Report

Thank you for reading. If you wish to download this Femtech SEA Market Map 2022 as a PDF file, please fill up the form HERE and we will send you a PDF file via email.

Market Map 2022 designed by Yamuna Rani Sundaram